Finding ways to protect your finances and maintain control over your bank account is essential. In today’s digital age, where online gambling has become increasingly accessible, it’s important to learn how to block gambling transactions on your bank account. Don’t worry, you’ve come to the right place. We’re going to show you some effective strategies to safeguard your funds and prevent gambling-related transactions from taking place. Let’s dive in and take control of your financial well-being!

Picture this: you’re scrolling through your bank statement and notice unauthorized charges from online casinos or gambling websites. It can be alarming and confusing, but fear not! We’re here to help you put a stop to those transactions and ensure your hard-earned money stays where it belongs – in your pocket. So, if you’re ready to take charge and protect your bank account from gambling-related expenses, keep reading for some practical tips you can implement today.

Whether you’re concerned about your own gambling habits or want to safeguard your account from unauthorized use by others, blocking gambling transactions on your bank account is a smart move. By taking proactive steps, you can regain control over your finances and enjoy peace of mind. In the following sections, we’ll walk you through the process, step by step. So, let’s get started and put a stop to gambling transactions once and for all!

- Contact Your Bank: Reach out to your bank’s customer service and inquire about blocking gambling transactions.

- Use Gambling Block Apps: Install gambling block apps on your phone or computer to restrict access to gambling sites.

- Activate Self-Exclusion Programs: Many gambling operators offer self-exclusion programs that prevent you from accessing their platforms.

- Set Up Spending Limits: Utilize your bank’s tools to set spending limits on your account, preventing large gambling transactions.

- Monitor and Review Your Statements: Regularly check your bank statements to identify any unauthorized gambling transactions and report them immediately.

How to Block Gambling on Your Bank Account?

Gambling addiction can have devastating effects on individuals and their families. It can lead to financial ruin, strained relationships, and even legal troubles. One effective way to combat gambling addiction is by blocking gambling transactions on your bank account. In this article, we will explore various methods and strategies to help you prevent gambling transactions from taking place.

Why Should You Block Gambling on Your Bank Account?

Before we delve into the methods of blocking gambling on your bank account, let’s understand why it is important to take this step. Gambling addiction is a serious problem that can lead to financial instability, strained relationships, and emotional distress. By blocking gambling transactions on your bank account, you can regain control over your finances and prevent further escalation of the addiction.

1. Talk to Your Bank

The first step in blocking gambling on your bank account is to reach out to your bank and explain your situation. Most banks have provisions in place to help customers block specific types of transactions, including gambling-related transactions. They may have specialized tools or features that allow you to set restrictions on your account. In some cases, they may even provide counseling or support services to help you overcome your addiction.

It is essential to be transparent and provide all the necessary information about your gambling addiction to your bank. They are legally bound to protect your financial well-being, and by blocking gambling transactions, they can assist you in your recovery journey.

Remember, each bank may have different procedures and policies when it comes to blocking gambling transactions. It is crucial to be patient and persistent in your communication with the bank to ensure that your request is processed effectively.

2. Utilize Gambling Blocking Software

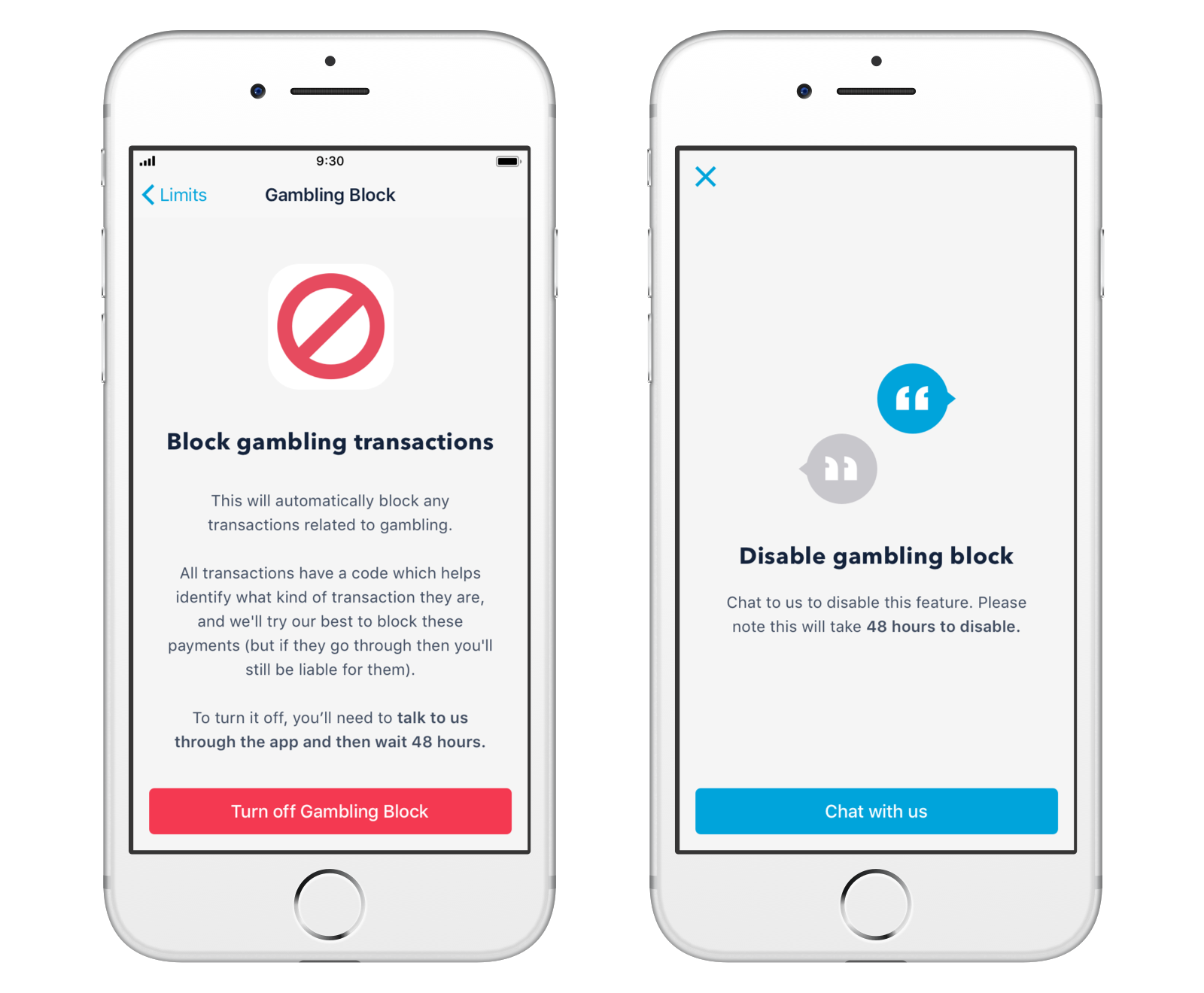

In addition to working with your bank, you can also leverage specialized gambling blocking software to further enhance your efforts to block gambling on your bank account. Many software solutions are designed specifically for this purpose and offer various features to help you stay in control.

These software applications can analyze transactions and block any gambling-related transactions from going through. They often have customizable settings that allow you to set your own restrictions, such as blocking specific websites or types of transactions. Some software even sends notifications or alerts if any attempt is made to process a gambling-related transaction.

By utilizing gambling blocking software, you add an extra layer of protection to your bank account and make it more challenging for you to engage in gambling activities. It provides an invaluable tool for individuals seeking to break free from their gambling addiction.

3. Seek Support from Gambling Addiction Programs

Blocking gambling on your bank account is an effective method to prevent impulsive gambling. However, it is crucial to address the root causes of your addiction and seek comprehensive support. Gambling addiction programs can provide the guidance and tools you need to overcome the challenges of addiction.

These programs offer counseling, therapy, and support group sessions to help individuals with gambling addiction. They provide a safe space to share experiences, learn coping mechanisms, and develop strategies to avoid relapse. By pairing the blocking of gambling transactions on your bank account with participation in these programs, you enhance your chances of long-term recovery.

In conclusion, blocking gambling on your bank account is an essential step in combating gambling addiction. By working with your bank, utilizing gambling blocking software, and seeking support from gambling addiction programs, you can regain control over your finances and improve your overall well-being. Remember, recovery from gambling addiction is a journey, and it requires perseverance, commitment, and a comprehensive approach.

Key Takeaways: How to Block Gambling on Your Bank Account

- Blocking gambling on your bank account can help prevent impulsive gambling behaviors.

- Contact your bank to inquire about options to block gambling transactions.

- Consider self-exclusion programs offered by gambling operators to restrict access to gambling sites.

- Monitor your bank statements regularly to detect any unauthorized gambling transactions.

- Seek professional help if you or someone you know is struggling with a gambling addiction.

Frequently Asked Questions

Are you looking to block gambling on your bank account? Here are some commonly asked questions and answers to help you navigate through the process.

1. Why should I block gambling on my bank account?

Blocking gambling on your bank account is an important step to help you curb excessive gambling habits. By blocking gambling transactions, you can gain control over your finances and protect yourself from potential financial harm.

When you block gambling, you are taking a proactive approach to manage your gambling behavior and prevent the temptation of utilizing funds earmarked for other essential purposes. It can provide peace of mind and create a more responsible approach to your financial habits.

2. How can I block gambling transactions on my bank account?

To block gambling transactions on your bank account, you can start by contacting your bank. They will be able to guide you through the process and provide you with the necessary steps to block gambling activity.

Typically, banks have measures in place to help customers restrict gambling-related transactions. This may include opting out of specific merchant categories or activating gambling-specific blocks on your account. By working closely with your bank, you can ensure that the necessary restrictions are in place to prevent gambling-related transactions.

3. Will blocking gambling on my bank account affect other transactions?

Blocking gambling on your bank account will not generally impact other regular transactions such as paying bills, making purchases, or transferring funds. The specific restrictions you put in place will focus solely on preventing gambling-related transactions.

It’s crucial to communicate your needs clearly with your bank, ensuring that they understand your intent to block gambling while still allowing other necessary financial activities. By providing clear instructions, you can tailor the restrictions to suit your needs without obstructing other day-to-day banking tasks.

4. Can I unblock gambling on my bank account if I change my mind?

Yes, in most cases, you can unblock gambling on your bank account if you change your mind. Banks recognize that customers may have evolving financial needs and allow for adjustments to restrictions placed on accounts.

It’s important to contact your bank and inform them of your decision to remove the gambling blocks on your account. They will guide you through the process, ensuring that the necessary amendments are made promptly.

5. Are there additional measures I can take to prevent gambling-related issues?

Apart from blocking gambling on your bank account, there are other steps you can take to prevent gambling-related issues. One option is to self-exclude from gambling sites or seek support from gambling helplines and support groups.

Additionally, educating yourself about responsible gambling practices and setting personal limits can also be beneficial. By combining multiple strategies, you increase your chances of effectively managing and overcoming gambling-related problems.

How To Block Gambling on Revolut

Summary

If you want to block gambling on your bank account, there are a few simple steps you can take. First, you can contact your bank and ask them to block any transactions related to gambling. You can also consider using a gambling blocking software or app to restrict access to gambling websites. It’s important to remember that blocking gambling on your bank account is just one step towards managing your gambling habits. Seeking support from friends, family, or professionals is essential for overcoming a gambling addiction. Remember, you’re not alone, and there are resources available to help you.